- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:How do we play?

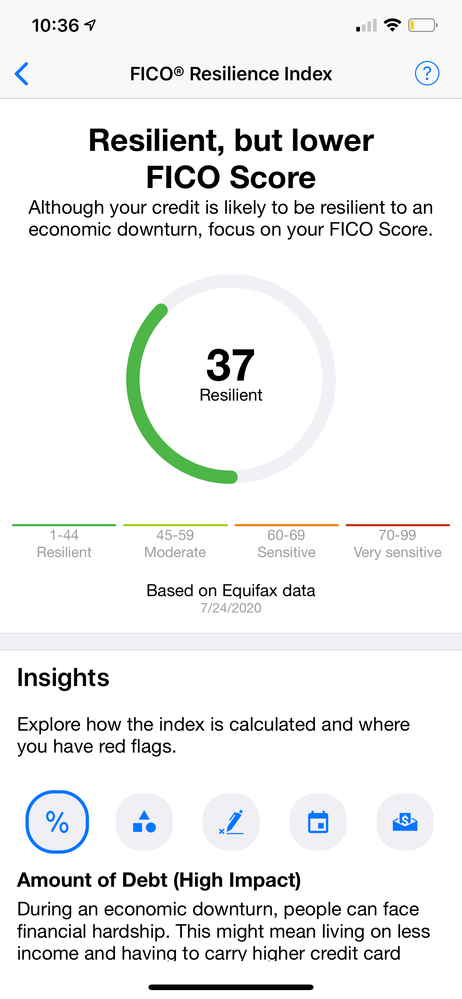

i think I've got a good one! I am working on my credit score but was pleasantly surprised with this! No red flags

This is beautiful! Best score so far and you now possess the coveted Golden Key!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Oh wow! I humbly accept ☺️

At least I am doing something right! now to find a house broker who takes the resilience score and the golden key as enough to give me a mortgage. #onecandream

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

EQ FICO Resilience Index Leaderboard as of August 31, 2020 |

Breaking News |

K-in-Boston STILL holds The Golden Chalice! even though Kenro also has a 72. Because 3 FLAGS beats a question mark!

Dogbert is still KEEPER of The Golden Sword! for having the lowest/highest/worst/best score ever!

The Realm of Resilience has been ROCKED!

@Anonymous arrives with a score of 37 and is now sole possessor of the Gold Key! FICO issued a press release about this score and it triggered a flurry of articles in the mainstream press. The Washington Post published an article about this 'new score'. Plenty more articles on Google here. Lots of article authors are wondering if/when consumers will be able to obtain their score. lol The first score was submitted to this thread on March 29, 2020.

This Resilience Index score is included with a myFICO subscription. It will be shown on the dashboard.

And as always - lower rating (higher number) doesn't mean that person has a bad credit profile in any way. This score is really sensitive to balance amounts and it doesn't matter if you have a 600 or 850. |

RECORD HOLDER |

| |

Dogbert | 76 |

MEMBER NAME | SCORES | RED | HIGH | DATE |

RESILIENT [1-44] | ||||

GOLD KEY WINNER |

| |||

Lulah | 37 | 0 | 37 | |

JWD1980 | 40 | 0 | 40 | |

Throckmorton's Wife | 40 | ? | 40 | |

| LaHossBoss* | 43 | 0 | 41 | |

| tacpoly | 43 | 0 | 43 | |

MODERATE [45-59] | ||||

| FireMedic1 | 45 | 2 | 45 | |

| PicoFico | 45 | 2 | 45 | |

| EW800 | 46 | 2 | 46 | |

| Thomas_Thumb | 48 | 2 | 48 | |

| Tonya-E | 47 | 2 | 47 | |

| Trudy | 49 | 2 | 49 | |

| sjt | 51 | 2 | 47 | |

Chris865 [OP] | 52 | 2 | 52 | |

| angelwingz | 53 | 2 | 53 | |

| KLEXH25 | 53 | 2 | 53 | |

| Credit4Growth | 54 | 2 | 54 | |

| CassieCard | 55 | 2 | 53 | |

| LaHossBoss SO | 55 | 2 | 52 | |

| Dumbee | 56 | 2 | 56 | |

| Flyingifr | 56 | 2 | 56 | |

| kilroy8 | 56 | ? | 56 | |

| TMB_ | 56 | 2 | 56 | |

| sarge12 | 59 | 2 | 59 | |

SENSITIVE [60-69] | ||||

| Brian_Earl_Spilner | 61 | 2 | 61 | |

| CreditObsessedinFL | 61 | 2 | 56 | |

| NRB525 | 63 | 2 | 63 | |

| Remedios | 63 | 2 | 63 | |

KEEPER OF THE GOLDEN SWORD |

| |||

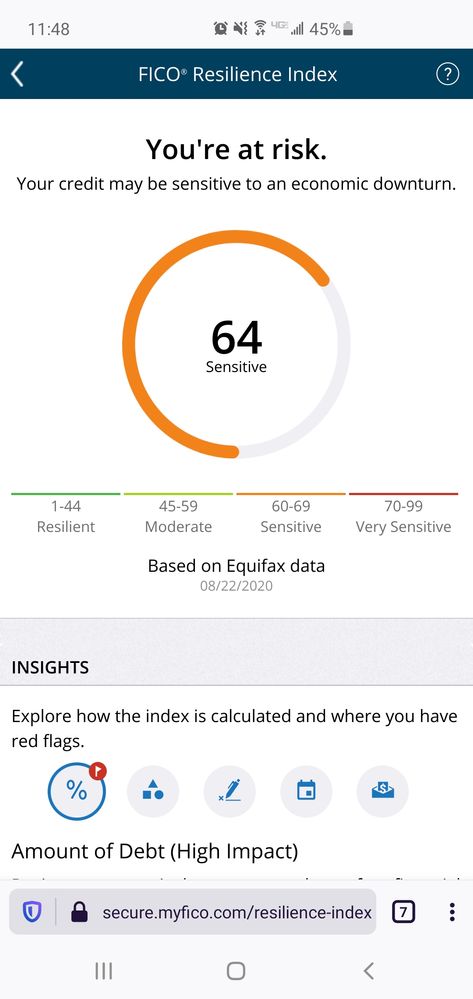

Dogbert* | 64 | 2 | 64 | |

| joeyv1985 | 65 | 2 | 64 | |

| Revelate | 65 | 2 | 63 | |

| Birdman7 | 66 | 2 | 60 | |

| RehabbingANDBlabbing | 66 | 2 | 66 | |

VERY SENSITIVE [70-99] | ||||

Kenro* | 72 | ? | 72 | |

GOLDEN CHALICE WINNER |

| |||

K-in-Boston | 72 | 3 | 72 |

* FORMER AWARD WINNERS * |

MEMBER NAME | AWARD | TROPHY | FOR | DATE |

Dogbert | GOLDEN CHALICE |

| Lowest rating: 76 | |

JWD1980 | GOLD KEY |

| Highest Rating: 40 | |

Kenro | GOLDEN CHALICE |

| Lowest rating: 72 | |

Kenro | GOLDEN SWORD |

| Record Low Rating: 72 | |

LaHossBoss | GOLD KEY |

| Highest rating: 41 | |

Throckmorton's Wife | GOLD KEY |

| Highest Rating: 40 |

All awards are from this game: Adventure (1980) (Atari 2600) Level 1 play through

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Man, I'm in the middle of the pack. It's mainly cause of my recent auto loan for my truck. ![]() No regrets though.

No regrets though. ![]()

2 red flags.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@OmarGB9 wrote:Man, I'm in the middle of the pack. It's mainly cause of my recent auto loan for my truck.

No regrets though.

2 red flags.

I bet your Resilience score will go down when your first payment is reported.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 813 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Oops, I forgot to give an update last month that I went back "up" to 73 with 3 flags. Just pulled my 3B reports for September, and still at 73 with 3 flags: "High revolving account balances" and "High installment loan amounts due" from the Amount of Debt tab and "High percent of revolving accounts" from the Credit Mix tab. FICO 8 scores all in the 800s with single-digit aggregate utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@K-in-Boston wrote:Oops, I forgot to give an update last month that I went back "up" to 73 with 3 flags. Just pulled my 3B reports for September, and still at 73 with 3 flags: "High revolving account balances" and "High installment loan amounts due" from the Amount of Debt tab and "High percent of revolving accounts" from the Credit Mix tab. FICO 8 scores all in the 800s with single-digit aggregate utilization.

Cool. I'm going to go ahead and make that 'Golden Sword in Golden Chalice' graphic now. You'll be a legend. 77 for the win!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I hope @Anonymous's iPhone battery is just as resilient as their score!

I'm not sure why my score really is what it is. I noted when I became one point more resilient in July that my balances went up, I opened a new credit card, I had a loan that was paid down a bit closed and had a new loan refi reporting; basically everything that causes a normal FICO score to get worse caused this score to get better. FICO scores get better, this score gets worse.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@K-in-Boston wrote:I hope @Anonymous's iPhone battery is just as resilient as their score!

I'm not sure why my score really is what it is. I noted when I became one point more resilient in July that my balances went up, I opened a new credit card, I had a loan that was paid down a bit closed and had a new loan refi reporting; basically everything that causes a normal FICO score to get worse caused this score to get better. FICO scores get better, this score gets worse.

Mathematically speaking, this opinion of mine defies reason, but I think this score really just gives up on truly evaluating someone's profile when they are above a certain length of history plus credit score. It seems like an exponential decay.

The CEO of FICO stated clearly on an earnings call that it was meant to evaluate edge cases.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I am not sure this score means anything. I had a score of 69... With 100k in debt.

Paid my debt down to 12k during this economic downturn amd still have a score of 69.

They have know way of knowing my income nor the reliability of it so at best they are guessing. Being able to pay down that much debt during a crisis should point to something more or a positive indicator