- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous No, you're absolutely correct. I plead lack of sleep. I was thinking of fico regular scoring. Definitely cares about monthly obligation. It may also care about utilization, too?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Trudy wrote:

@Anonymous wrote:

@Trudy wrote:Sounds about right

Increase your debt load exponentially and you can remove that flag. Sounds like a plan for resiliency if ever I heard of one.

Oh no, @Trudy , Life is not that easy. Once you go get that installment loan the flag will be replaced by high installment balances, just ask @Remedios. I imagine once you pay it down to 9% you can get rid of flags relating to installment. Lol.

@Anonymous Well you've done a great job and you've contributed a great deal to the community while doing so! Sure glad you decided to do this. I have enjoyed learning with you and from you.

Oh, I'm aware my friend @Anonymous , it's my 2nd flag: High installment loan due that will likely replace it. And my 1st flag: High % of revolving accounts, well… I have no other choice other than to accept my ranking with this new.fandango.thing.

At least it’s something we can all try to dissect as this seems to be what drives many of us here anyway. I'm going to try to bow out although I may use this thread for entertainment purposes going forward until I have some kind of an awakening.

And ditto to the @Anonymous mention.

@Trudy oh no. I won't be dissecting this. That's what I've already been using this thread for is entertainment, LOL. 😉

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:Again, I feel like it is more about monthly obligations than the standard scoring stuff like baddies and utilization. this is a gross simplification, of course. "How well someone will do in an economic downturn" sounds like "they will be (un)likely to keep up with their monthly obligations because they are low/high.

I think you're right about the total monthly obligations.

Since this is logistic regression, it's really ""How well someone with my profile data did during that economic downturn". The downturn being the Great Recession, and the dataset used for regression is profile data from around that time.

They already have data on who 'failed' that stress test, and those profiles no doubt had increasing utilization common to all of them. Probably a lot of 800s in that subset, with high income and great payment history - which we now know, years later, didn't mean much when so many financial executives lost their jobs and probably 100pts on their credit scores.

I'm really not surprised that you got a 41 Resilient on this, and it turns out they actually got it perfectly right: you're actively trying to improve your credit profile and are certainly not going to let another derogatory slip in there if you can help it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

ok so this will be an interesting comparison.

3 April 2020 - when I pulled my last 3B MF report, it was at 76 - very sensitive.

- High revolving accoun balances

- high installment loan balances.

- High percent of revolving accounts

FICO8's were EQ685, TU711, EX693

UTIL 53%

5 cards reported right then as > 75% utilization

Only bad on EQ is a 2.5yr old paid collection from vzw that still annoys me. Seems to only affect FICO9 scoring though.

I am due to pull my next 3B MF report. (DW and I share a fam plan so I can't get the monthly updates without paying lots more. MF promised me a monthly family plan at some point - sadly haven't delivered it yet... boooo)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Deleted because reasons.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

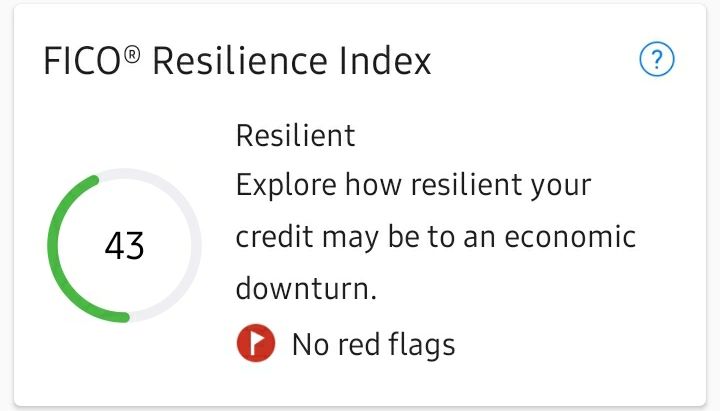

@Anonymous , sorry, I gave you the wrong resiliency score. It is actually 43

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:@Anonymous , sorry, I gave you the wrong resiliency score. It is actually 43

I love it....and still no red flags.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

EQ FICO Resilience Index - Leaderboard as of June 24, 2020

We have a new winner! @Anonymous has been awarded The Golden Chalice!

*Note about this score: Lower rating (higher number) doesn't mean that person has a bad credit profile in any way. We're in Equiland now...

Member Name | Score | Red | High | Date Posted |

RESILIENT [1-44] | ||||

| Throckmorton's Wife | 40 | ? | 40 | |

| LaHossBoss | 43 | 0 | 41 | |

MODERATE [45-59] | ||||

| FireMedic1 | 45 | 2 | 45 | |

| PicoFico | 45 | 2 | 45 | |

| EW800 | 46 | 2 | 46 | |

| tacpoly | 47 | 2 | 46 | |

| Thomas_Thumb | 48 | 2 | 48 | |

| Tonya-E | 48 | 2 | 48 | |

| Trudy | 49 | 2 | 49 | |

| sjt | 51 | 2 | 47 | |

Chris865 [OP] | 52 | 2 | 52 | |

| LaHossBoss SO | 52 | 2 | 52 | |

| angelwingz | 53 | 2 | 53 | |

| CassieCard | 54 | 2 | 53 | |

| Flyingifr | 56 | 2 | 56 | |

| TMB_ | 56 | 2 | 56 | |

| CreditObsessedinFL | 59 | 2 | 56 | |

| sarge12 | 59 | 2 | 59 | |

SENSITIVE [60-69] | ||||

| Birdman7 | 60 | 2 | 60 | |

| Brian_Earl_Spilner | 61 | 2 | 61 | |

| NRB525 | 63 | 2 | 63 | |

| Remedios | 63 | 2 | 63 | |

| Revelate | 65 | 2 | 63 | |

| RehabbingANDBlabbing | 66 | 2 | 66 | |

| Dumbee | 67 | ? | 67 | |

VERY SENSITIVE [70-99] | ||||

| Kenro | 72 | ? | 72 | |

GOLDEN CHALICE |  | |||

| Dogbert | 76 | 3! | 76 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Wooooo! Golden chalice!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Sadly, I have to relinquish my golden chalice, @Anonymous

Just pulled my new MF 3B - because everything *FINALLY* posted from the various cards to all three CRAs.

I'm down to a 64/2 - High percent of revolving accounts and High installment loan balances

If you want a good golden chalice winner, give it to @Anonymous - she and I tie at 76/3... though when she eventually pulls her new quarterly MF 3B, she'll probably lose the chalice as well.