- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@K-in-Boston wrote:I hope @Anonymous's iPhone battery is just as resilient as their score!

I'm not sure why my score really is what it is. I noted when I became one point more resilient in July that my balances went up, I opened a new credit card, I had a loan that was paid down a bit closed and had a new loan refi reporting; basically everything that causes a normal FICO score to get worse caused this score to get better. FICO scores get better, this score gets worse.

I think this score attempts to acheive a goal that is more dependant on data that is not on a credit report. If the goal is to judge how resilient my fico score is to economic downturn of the economy, the 400k in savings I have, and the fact that my income is not derived from a traditional paycheck, but social security. Also my total amount of debt is less than 5% of my savings. The fact that both income, and savings are not part of the data included in a credit report, makes a credit report a weak indicator of my ability to maintain a consistantly high credit score. Savings and assets, minus debt, is what most would consider wealth. Since wealth is not allowed by law to be in a credit report, it can't, and wont be the best indicator of credit profile resilience. A lender can and does absolutely use income and DTI in lending decisions and always has. It is why income verification through paycheck stubs or 4506-T requests are used for mortgage loans or financial reviews. I personally never have and never will agree to a 4506-T request to obtain or keep any credit card. I certainly would not send a copy of my Vangard fiduciary trust statement for a card either. If the issuer does not believe my self reported income to issue me a card or allow me to keep a card, then they can not issue me the card, or cancel my existing card. The number of data breach reports alone will guarantee that I will not supply those items to a credit card issuer, not to mention the fact an issuer may sell access to such data to what they call partners.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sjt wrote:

@OmarGB9 wrote:Man, I'm in the middle of the pack. It's mainly cause of my recent auto loan for my truck.

No regrets though.

2 red flags.

I bet your Resilience score will go down when your first payment is reported.

Well I got the loan back in February. Made 1 regularly scheduled payment, 1 extra payment, then got COVID deferral until last month, at which point I made my second regularly scheduled payment along with a second extra payment. These last 2 payments came in before I pulled this score.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:

@K-in-Boston wrote:I hope @Anonymous's iPhone battery is just as resilient as their score!

I'm not sure why my score really is what it is. I noted when I became one point more resilient in July that my balances went up, I opened a new credit card, I had a loan that was paid down a bit closed and had a new loan refi reporting; basically everything that causes a normal FICO score to get worse caused this score to get better. FICO scores get better, this score gets worse.

I think this score attempts to acheive a goal that is more dependant on data that is not on a credit report. If the goal is to judge how resilient my fico score is to economic downturn of the economy, the 400k in savings I have, and the fact that my income is not derived from a traditional paycheck, but social security. Also my total amount of debt is less than 5% of my savings. The fact that both income, and savings are not part of the data included in a credit report, makes a credit report a weak indicator of my ability to maintain a consistantly high credit score. Savings and assets, minus debt, is what most would consider wealth. Since wealth is not allowed by law to be in a credit report, it can't, and wont be the best indicator of credit profile resilience. A lender can and does absolutely use income and DTI in lending decisions and always has. It is why income verification through paycheck stubs or 4506-T requests are used for mortgage loans or financial reviews. I personally never have and never will agree to a 4506-T request to obtain or keep any credit card. I certainly would not send a copy of my Vangard fiduciary trust statement for a card either. If the issuer does not believe my self reported income to issue me a card or allow me to keep a card, then they can not issue me the card, or cancel my existing card. The number of data breach reports alone will guarantee that I will not supply those items to a credit card issuer, not to mention the fact an issuer may sell access to such data to what they call partners.

@sarge12 But one teensy problem. Wealth is not an indicator of whether a person will pay. Wealthy people are some of the ones that burned lenders the most back not long ago.

Just because you can pay is not indicative that you will.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:Wealth is not an indicator of whether a person will pay. Wealthy people are some of the ones that burned lenders the most back not long ago.

Just because you can pay is not indicative that you will.

+10 for that. In fact, going by what was observed during the Great Recession with mortgages, high income and wealth should actually lower scores. lol Make more, spend more, and end up paycheck to paycheck anyway.

"The CoreLogic data suggest that the rich do not seem to have concerns about the civic good uppermost in their mind, especially when it comes to investment and second homes. Nor do they appear to be particularly worried about being sued by their lender or frozen out of future loans by Fannie Mae, possible consequences of default." (Link)

I like credit scoring the way it is, because it gives a cashier making $16,000 a year an equal opportunity for a good credit rating. Job type and income aren't going to show the moment in time someone decided to take up gambling and incur heavy losses, but the payment/utilization history sure will. It's an early warning system for lenders after all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

EQ FICO Resilience Index Leaderboard as of September 7, 2020 |

Breaking News |

K-in-Boston STILL holds The Golden Chalice! even though Kenro also has a 72. Because 3 FLAGS beats a question mark!

Dogbert is still KEEPER of The Golden Sword! for having the lowest/highest/worst/best score ever!

The Realm of Resilience has been ROCKED!

Lulah arrives with a score of 37 and is now sole possessor of the Gold Key! FICO issued a press release about this score and it triggered a flurry of articles in the mainstream press. The Washington Post published an article about this 'new score'. Plenty more articles on Google here. Lots of article authors are wondering if/when consumers will be able to obtain their score. lol The first score was submitted to this thread on March 29, 2020.

This Resilience Index score is included with a myFICO subscription. It will be shown on the dashboard.

And as always - lower rating (higher number) doesn't mean that person has a bad credit profile in any way. This score is really sensitive to balance amounts and it doesn't matter if you have a 600 or 850. |

RECORD HOLDER |

| |

Dogbert | 76 |

MEMBER NAME | SCORES | RED | HIGH | DATE |

RESILIENT [1-44] | ||||

GOLD KEY WINNER |

| |||

Lulah | 37 | 0 | 37 | |

JWD1980 | 40 | 0 | 40 | |

Throckmorton's Wife | 40 | ? | 40 | |

| LaHossBoss* | 43 | 0 | 41 | |

| tacpoly | 43 | 0 | 43 | |

MODERATE [45-59] | ||||

| FireMedic1 | 45 | 2 | 45 | |

| PicoFico | 45 | 2 | 45 | |

| EW800 | 46 | 2 | 46 | |

| Thomas_Thumb | 48 | 2 | 48 | |

| Tonya-E | 47 | 2 | 47 | |

| Trudy | 49 | 2 | 49 | |

| sjt | 51 | 2 | 47 | |

Chris865 [OP] | 52 | 2 | 52 | |

| angelwingz | 53 | 2 | 53 | |

| KLEXH25 | 53 | 2 | 53 | |

| Credit4Growth | 54 | 2 | 54 | |

| CassieCard | 55 | 2 | 53 | |

| LaHossBoss SO | 55 | 2 | 52 | |

| Dumbee | 56 | 2 | 56 | |

| Flyingifr | 56 | 2 | 56 | |

| kilroy8 | 56 | ? | 56 | |

| TMB_ | 56 | 2 | 56 | |

| sarge12 | 59 | 2 | 59 | |

SENSITIVE [60-69] | ||||

| CreditObsessedinFL | 61 | 2 | 56 | |

| NRB525 | 63 | 2 | 63 | |

| Remedios | 63 | 2 | 63 | |

KEEPER OF THE GOLDEN SWORD |

| |||

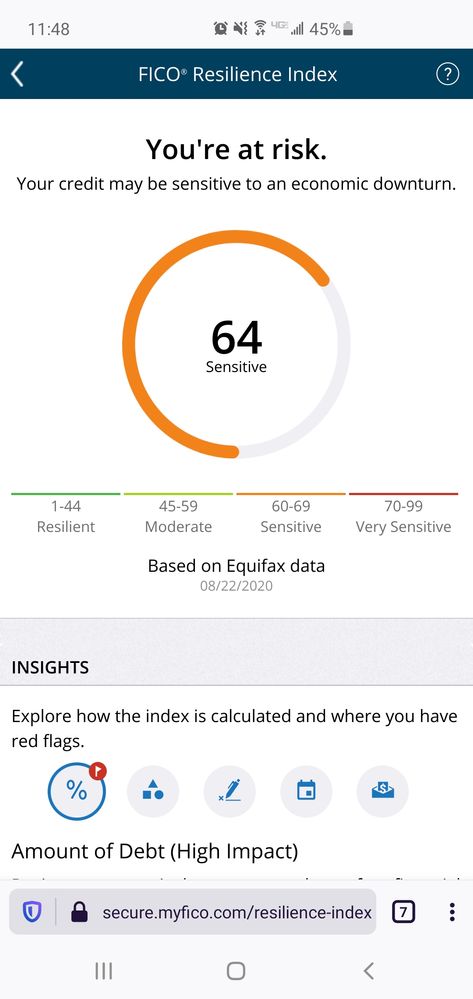

Dogbert* | 64 | 2 | 64 | |

| OmarGB9 | 64 | 2 | 64 | |

| joeyv1985 | 65 | 2 | 64 | |

| Revelate | 65 | 2 | 63 | |

| Birdman7 | 66 | 2 | 60 | |

| RehabbingANDBlabbing | 66 | 2 | 66 | |

| Brian_Earl_Spilner | 68 | 2 | 61 | |

| jayk1 | 69 | ? | 69 | |

VERY SENSITIVE [70-99] | ||||

Kenro* | 72 | ? | 72 | |

GOLDEN CHALICE WINNER |

| |||

K-in-Boston | 73 | 3 | 72 |

* FORMER AWARD WINNERS * |

MEMBER NAME | AWARD | TROPHY | FOR | DATE |

Dogbert | GOLDEN CHALICE |

| Lowest rating: 76 | |

JWD1980 | GOLD KEY |

| Highest Rating: 40 | |

Kenro | GOLDEN CHALICE |

| Lowest rating: 72 | |

Kenro | GOLDEN SWORD |

| Record Low Rating: 72 | |

LaHossBoss | GOLD KEY |

| Highest rating: 41 | |

Throckmorton's Wife | GOLD KEY |

| Highest Rating: 40 |

All awards are from this game: Adventure (1980) (Atari 2600) Level 1 play through

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@sarge12 wrote:

@K-in-Boston wrote:I hope @Anonymous's iPhone battery is just as resilient as their score!

I'm not sure why my score really is what it is. I noted when I became one point more resilient in July that my balances went up, I opened a new credit card, I had a loan that was paid down a bit closed and had a new loan refi reporting; basically everything that causes a normal FICO score to get worse caused this score to get better. FICO scores get better, this score gets worse.

I think this score attempts to acheive a goal that is more dependant on data that is not on a credit report. If the goal is to judge how resilient my fico score is to economic downturn of the economy, the 400k in savings I have, and the fact that my income is not derived from a traditional paycheck, but social security. Also my total amount of debt is less than 5% of my savings. The fact that both income, and savings are not part of the data included in a credit report, makes a credit report a weak indicator of my ability to maintain a consistantly high credit score. Savings and assets, minus debt, is what most would consider wealth. Since wealth is not allowed by law to be in a credit report, it can't, and wont be the best indicator of credit profile resilience. A lender can and does absolutely use income and DTI in lending decisions and always has. It is why income verification through paycheck stubs or 4506-T requests are used for mortgage loans or financial reviews. I personally never have and never will agree to a 4506-T request to obtain or keep any credit card. I certainly would not send a copy of my Vangard fiduciary trust statement for a card either. If the issuer does not believe my self reported income to issue me a card or allow me to keep a card, then they can not issue me the card, or cancel my existing card. The number of data breach reports alone will guarantee that I will not supply those items to a credit card issuer, not to mention the fact an issuer may sell access to such data to what they call partners.

@sarge12 But one teensy problem. Wealth is not an indicator of whether a person will pay. Wealthy people are some of the ones that burned lenders the most back not long ago.

Just because you can pay is not indicative that you will.

I absolutely agree that wealth is not an indicator of whether someone will pay. The last data I saw shows that on average millionaires declare bankruptcy 3.5 times in their lifetime. It is however in my opinion the main contributor to a debtors ability to pay. The fico score itself was devised as a predictor of default on debt. That is not what this resilience index score is claiming to be for. This index is supposedly to indicate the debtors ability to maintain their current credit profile if the economy declines. The truth is that a person who has over 20 times the savings of their debt load is not susceptible to economic declines the same way those who might lose their jobs are. My income is from savings, and SSDI, and does not change when recession hits. I have no job to lose, so any scoring matrix that aims to determine my high scores resilience to an economic downturn is nonsense. The consistently high fico score is highly indicative of responsible use of credit, and I fail to see how an economic downturn that does not decrease my income a cent has any affect on my scores resilience. Normally the person who has their scores drop due to an economic downturn, does so because their income is adversely affected to no longer be able to pay their debts. In my case, the pandemic and recession affected my income only by getting an extra 1200 dollars via the stimulus. If anything my liklihood of default has decreased. This score is affected by having high credit limits and a high number of cards, which makes sense if the recession causes someone to rely on credit to survive the downturn causing a loss of income. If personal income and savings is not adversely affected, that unused available credit is irrelevant to the ability to maintain high credit scores.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous it's time for me to make a move for that top spot. I'm up to 68 now. High revolving and high installment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Brian_Earl_Spilner wrote:@Anonymous it's time for me to make a move for that top spot. I'm up to 68 now. High revolving and high installment.

Updated!

Good luck, but @K-in-Boston is a very formidable opponent!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Brian_Earl_Spilner wrote:@Anonymous it's time for me to make a move for that top spot. I'm up to 68 now. High revolving and high installment.

Updated!

Good luck, but @K-in-Boston is a very formidable opponent!

It's ok. I know his weakness. Forgetting to use rakuten.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Brian_Earl_Spilner wrote:

@Anonymous wrote:

@Brian_Earl_Spilner wrote:@Anonymous it's time for me to make a move for that top spot. I'm up to 68 now. High revolving and high installment.

Updated!

Good luck, but @K-in-Boston is a very formidable opponent!

It's ok. I know his weakness. Forgetting to use rakuten.

Clue me in @Brian_Earl_Spilner, I am stuck at only 1 point away from being sensitive. I need that point, so I can come here and bragg about how sensitive I have become. I am tired of riding down the center line on this highway to credit resilience hell. I want to cross that line and take aim at oncoming traffic. I have been at the top of the moderate crowd long as I care to. So what is this rakuten you speak of? I am not looking to challenge you and @K-in-Boston , I just want to join the sensitive gang.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20