- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: EQ FICO Resilience Index - New Year's Eve 2020

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index - New Year's Eve 2020

Per my inquiry above, it appears that my so-so score is because of the number of open accounts that I have. Although they are almost all $0 balance, I do have quite a few open revolving accounts.

Sept 2024: EX8: 847; EQ8: 850; TU8: 848 -- Middle Mortgage Score: 821

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index - New Year's Eve 2020

@EW800 wrote:Just thought I would share that my Resilience Index is still 46. It has been 46 every month for the last many months - hasn't changed at all.

I understand the score is sensitive to balance amounts. I am wondering if it is possible that my very low balances are actually hurting me as far as this score?

This score loves low balances - it can't be that.

I wonder how your profile compares to @tacpoly 's. She jumped up to a 39 with a very low balance and an EQ8 850. This is really the best so far, considering both scores together.

I can't get below 53, and that's probably because I just don't have enough credit history at 3 years in. That doesn't seem to be the case for you, though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index - New Year's Eve 2020

@Anonymous wrote:

@EW800 wrote:Just thought I would share that my Resilience Index is still 46. It has been 46 every month for the last many months - hasn't changed at all.

I understand the score is sensitive to balance amounts. I am wondering if it is possible that my very low balances are actually hurting me as far as this score?

This score loves low balances - it can't be that.

I wonder how your profile compares to @tacpoly 's. She jumped up to a 39 with a very low balance and an EQ8 850. This is really the best so far, considering both scores together.

I can't get below 53, and that's probably because I just don't have enough credit history at 3 years in. That doesn't seem to be the case for you, though.

@Anonymous I have a feeling number of open primary CCs may be a factor in the Resilience Index -- i.e. how much potential trouble someone can get into. I have 1 charge card and 3 credit cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index - New Year's Eve 2020

@tacpoly wrote:@Anonymous I have a feeling number of open primary CCs may be a factor in the Resilience Index -- i.e. how much potential trouble someone can get into. I have 1 charge card and 3 credit cards.

A lot of FICO score models have the 'Too few or too many accounts' factor, so I think you're right about potential for trouble. Their profile data regression must have shown a problem with either of those.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index - New Year's Eve 2020

Happy New Year!

As of 1.6.21:

Resilience Score: 47 was 51.

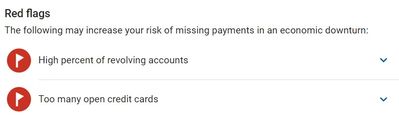

Red Flags: 1) Too many open credit cards and 2) High percentage of revolving credit.

Bank of America: Alaska Air Atmos Summit Visa Infinite

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Globe WLMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 816 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EQ FICO Resilience Index Leaderboard - January 10, 2021

EQ FICO Resilience Index

Leaderboard as of January 10, 2021 |

Breaking News |

@sjt 51 to 47.

|

General Information about this score |

This Resilience Index score is included with a myFICO subscription. It will be shown on the dashboard.

And as always - lower rating (higher number) doesn't mean that person has a bad credit profile in any way. This score is really sensitive to balance amounts and it doesn't matter if you have a 600 or 850. |

RECORD HOLDER |

| EQ FICO RESILIENCE INDEX |

Adkins | 80 |

MEMBER NAME | SCORES | RED | HIGH | DATE |

RESILIENT [1-44] | ||||

GOLD KEY WINNER |

| |||

mrsgrits' DH | 32 | 0 | 32 | |

| LP007 | 34 | 0 | 34 | |

| CreditBones | 37 | 0 | 37 | |

juggernaut9* | 37 | 0 | 37 | |

Lulah* | 37 | 0 | 37 | |

| USDOD | 37 | 0 | 37 | |

THE BAT |

| |||

tacpoly [EQ 8 850] | 39 | 0 | 39 | |

JWD1980* | 40 | 0 | 40 | |

Throckmorton's Wife* | 40 | ? | 40 | |

| LaHossBoss SO | 44 | 0 | 44 | |

MODERATE [45-59] | ||||

| FireMedic1 | 45 | 2 | 45 | |

| PicoFico | 45 | 2 | 45 | |

| EW800 | 46 | 2 | 46 | |

| Tonya-E | 46 | 2 | 46 | |

| sjt | 47 | 2 | 47 | |

| LaHossBoss* | 48 | 2 | 41 | |

| Thomas_Thumb | 48 | 2 | 48 | |

| jasonbourne84 | 49 | 2 | 49 | |

| Trudy | 49 | 2 | 49 | |

Chris865 [OP] | 52 | 2 | 52 | |

| angelwingz | 53 | 2 | 53 | |

| KLEXH25 | 53 | 2 | 53 | |

| CassieCard | 54 | 2 | 53 | |

| Credit4Growth | 54 | 2 | 54 | |

| Face_Value | 54 | 2 | 54 | |

| Flyingifr | 56 | 2 | 56 | |

| kilroy8 | 56 | ? | 56 | |

| TMB_ | 56 | 2 | 56 | |

| mrsgrits | 57 | 2 | 57 | |

| Bowiefan | 58 | ? | 58 | |

| sarge12 | 59 | 2 | 59 | |

SENSITIVE [60-69] | ||||

| joeyv1985 | 60 | 2 | 58 | |

| coreysw12 | 61 | 2 | 60 | |

| CreditObsessedinFL | 63 | 2 | 56 | |

| NRB525 | 63 | 2 | 63 | |

| Remedios | 63 | 2 | 63 | |

Dogbert* | 64 | 2 | 64 | |

| OmarGB9 | 64 | 2 | 64 | |

| Revelate | 65 | 2 | 63 | |

| RehabbingANDBlabbing | 66 | 2 | 66 | |

| thornback | 66 | 2 | 66 | |

| Dumbee | 68 | 2 | 56 | |

| Birdman7 | 69 | 2 | 60 | |

| jayk1 | 69 | ? | 69 | |

VERY SENSITIVE [70-99] | ||||

K-in-Boston* | 70 | 3 | 70 | |

CreditCuriosity* | 72 | 3 | 72 | |

Dmessina666* | 72 | 3 | 72 | |

jasonbourne84's DH | 72 | 3 | 72 | |

Kenro* | 72 | ? | 72 | |

GApeachy | 74 | 3 | 73 | |

Brian_Earl_Spilner* | 78 | 3 | 72 | |

GOLDEN CHALICE WINNER AND |

|

| ||

Adkins | 80 | 3 | 80 |

* FORMER AWARD WINNERS * |

MEMBER NAME | AWARD | TROPHY | FOR | DATE |

Brian_Earl_Spilner | GOLDEN CHALICE |

| Lowest rating: 76 | |

Brian_Earl_Spilner | GOLDEN SWORD |

| Record Low Rating: 76 | |

CreditCuriosity | GOLDEN CHALICE |

| Lowest rating: 75 | |

Dmessina666 | GOLDEN CHALICE |

| Lowest rating: 78 | |

Dmessina666 | GOLDEN SWORD |

| Record Low Rating: 78 | |

Dogbert | GOLDEN CHALICE |

| Lowest rating: 76 | |

Dogbert | GOLDEN SWORD |

| Record Low Rating: 76 | |

juggernaut9 | GOLD KEY |

| Highest Rating: 37 | |

JWD1980 | GOLD KEY |

| Highest Rating: 40 | |

K-in-Boston | GOLDEN CHALICE |

| Lowest rating: 73 | |

Kenro | GOLDEN CHALICE |

| Lowest rating: 72 | |

Kenro | GOLDEN SWORD |

| Record Low Rating: 72 | |

LaHossBoss | GOLD KEY |

| Highest rating: 41 | |

Lulah | GOLD KEY |

| Highest Rating: 37 | |

Throckmorton's Wife | GOLD KEY |

| Highest Rating: 40 |

All awards are from this game: Adventure (1980) (Atari 2600) Level 3 play through

The Bat is awarded for best EQ 8 score with lowest Resilience Index score. The bat can fly away with any award - even a dragon!

Meet the creator of the Resilience Index.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - January 10, 2021

lol! @Anonymous

I think the decrease was the result of one revolver reporting at less than 1% on the card and overall.

Bank of America: Alaska Air Atmos Summit Visa Infinite

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Globe WLMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 816 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - January 10, 2021

Hi Cassie,

I was too busy and also too afraid to look last month (DEC) because had a 3K charge that I put on a 0 balance card and although I paid it off the next day, it still hit my report because I missed the statement date by one day I guess. I peeked just now and saw that for DECEMBER I dropped back to a 61 from a 63, same two red flags and it showed 12% up from 9% overall UTI.

Could also be that student loan servicer for my son's PPL has changed, so the loans look like they dropped off for a month. I will update for this month when the 3D comes out for me, which is on 1/17.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - January 10, 2021

@CreditobsessedinFL wrote:Hi Cassie,

I was too busy and also too afraid to look last month (DEC) because had a 3K charge that I put on a 0 balance card and although I paid it off the next day, it still hit my report because I missed the statement date by one day I guess. I peeked just now and saw that for DECEMBER I dropped back to a 61 from a 63, same two red flags and it showed 12% up from 9% overall UTI.

Could also be that student loan servicer for my son's PPL has changed, so the loans look like they dropped off for a month. I will update for this month when the 3D comes out for me, which is on 1/17.

Missed the statement date? Goot gawd, man. This is paramount to our collective success. We'll never get off this island of despair if we don't all do our part. ![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - January 10, 2021

@LP007 wrote:

@CreditobsessedinFL wrote:Hi Cassie,

I was too busy and also too afraid to look last month (DEC) because had a 3K charge that I put on a 0 balance card and although I paid it off the next day, it still hit my report because I missed the statement date by one day I guess. I peeked just now and saw that for DECEMBER I dropped back to a 61 from a 63, same two red flags and it showed 12% up from 9% overall UTI.

Could also be that student loan servicer for my son's PPL has changed, so the loans look like they dropped off for a month. I will update for this month when the 3D comes out for me, which is on 1/17.

Missed the statement date? Goot gawd, man. This is paramount to our collective success. We'll never get off this island of despair if we don't all do our part.

lol @LP007