- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: EQ FICO Resilience Index Leaderboard - Sunday,...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - March 3, 2021

I just got my March 3B pull and my score (56) and red flags remain the same. It will be interesting to see what happens to the score and red flags when my two new cards start reporting.

Current FICO 8 | 9 (April 2025):

Credit Age:

Inquiries (6/12/24):

Banks & CUs:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - March 3, 2021

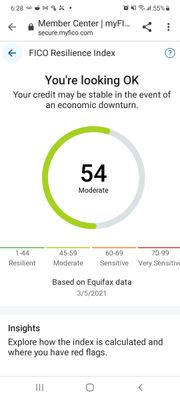

Just pulled my 3B report and I'm still ridin 54 with the same 2 red flags.

1. High installment balance

2. High percentage of revolving accounts. Uh yeah 4 but Ok.

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Here's something more recent from FICO about what it takes to be 'Resilient'.

We've got actual numbers now for inquiries, balances, and number of active accounts in the past year.

Credit Mix surprised me: they're looking for at least half of all tradelines to be installment loans such as mortgage, auto, and personal.

I'm going to be reporting $912 in total balances this month, down from $1807 last month. Guess I should have paid down another $13 to be below $900 according to this graphic. Too late for this month, but it's a good reference point slightly above $900.

Full paper is here: https://www.fico.com/en/resource-access/download/13846

The paper also shows an example use of a dual-matrix, combining the index score with an Auto 8 score to compute an offset.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:Here's something more recent from FICO about what it takes to be 'Resilient'.

We've got actual numbers now for inquiries, balances, and number of active accounts in the past year.

Credit Mix surprised me: they're looking for at least half of all tradelines to be installment loans such as mortgage, auto, and personal.

I'm going to be reporting $912 in total balances this month, down from $1807 last month. Guess I should have paid down another $13 to be below $900 according to this graphic. Too late for this month, but it's a good reference point slightly above $900.

Full paper is here: https://www.fico.com/en/resource-access/download/13846

The paper also shows an example use of a dual-matrix, combining the index score with an Auto 8 score to compute an offset.

Looks like I need to add a few more installment tradelines to even out my massive revolving profile 😆

Seriously though this is very informative and appreciate your contributions.

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Mr_Mojo_Risin wrote:Looks like I need to add a few more installment tradelines to even out my massive revolving profile 😆

4 cards....yeah we're both livin' on the edge alright! lol

I've got 1 each of Mastercard, Visa, American Express, and Discover, with a single closed $500 credit builder loan on my 3yr3mo old credit file. The only credit related thing I will need in the future is a big ol' Share-Size mortgage.

It looks like low balances are more important than anything else with this score. But I don't think I'll make it below 50 even going to AZEO with $20 in aggregate balance next month. I just don't have enough credit history length at this point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Mr_Mojo_Risin wrote:Looks like I need to add a few more installment tradelines to even out my massive revolving profile 😆

4 cards....yeah we're both livin' on the edge alright! lol

I've got 1 each of Mastercard, Visa, American Express, and Discover, with a single closed $500 credit builder loan on my 3yr3mo old credit file. The only credit related thing I will need in the future is a big ol' Share-Size mortgage.

It looks like low balances are more important than anything else with this score. But I don't think I'll make it below 50 even going to AZEO with $20 in aggregate balance next month. I just don't have enough credit history length at this point.

I have pretty much the same cards as you (payment network). My oldest account is 3yr5mo which is a closed auto loan.

I wouldn't mind going for a mortgage in the next year or so, I'm not getting any younger. Gotta make a move sooner rather than later lol.

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EQ FICO Resilience Index Leaderboard - Sunday, March 7, 2021

EQ FICO Resilience Index

Leaderboard as of Sunday, March 7, 2021 |

Breaking News |

New in-depth information about this score from FICO.

New Gold Key Winner! @juggernaut9 with a 32 ! 2nd time winning the Gold Key!

|

General Information about this score |

This Resilience Index score is included with a myFICO subscription. It will be shown on the dashboard.

And as always - lower rating (higher number) doesn't mean that person has a bad credit profile in any way. This score is really sensitive to balance amounts and it doesn't matter if you have a 600 or 850. |

RECORD HOLDER |

| EQ FICO RESILIENCE INDEX |

Adkins | 80 |

MEMBER NAME | SCORES | RED | HIGH | DATE |

RESILIENT [1-44] | ||||

GOLD KEY WINNERS |

| |||

juggernaut9* | 32 | 0 | 32 | |

mrsgrits' DH | 32 | 0 | 32 | |

| LP007 | 34 | 0 | 34 | |

| CreditBones | 37 | 0 | 37 | |

Lulah* | 37 | 0 | 37 | |

| USDOD | 37 | 0 | 37 | |

THE BAT |

| |||

tacpoly [EQ 8 850] | 39 | 0 | 39 | |

JWD1980* | 40 | 0 | 40 | |

| LaHossBoss SO | 40 | 0 | 40 | |

Throckmorton's Wife* | 40 | ? | 40 | |

| Tonya-E | 43 | 0 | 43 | |

MODERATE [45-59] | ||||

| FireMedic1 | 45 | 2 | 45 | |

| LaHossBoss* | 45 | 2 | 41 | |

| PicoFico | 45 | 2 | 45 | |

| Bankrupt2019 | 46 | 2 | 46 | |

| EW800 | 46 | 2 | 46 | |

| sjt | 47 | 2 | 47 | |

| Thomas_Thumb | 48 | 2 | 48 | |

| jasonbourne84 | 49 | 2 | 49 | |

| Trudy | 49 | 2 | 49 | |

Chris865 [OP] | 52 | 2 | 52 | |

| angelwingz | 53 | 2 | 53 | |

| KLEXH25 | 53 | 2 | 53 | |

| Mr_Mojo_Risin | 54 | ? | 54 | |

| Credit4Growth | 54 | 2 | 54 | |

| Face_Value | 54 | 2 | 54 | |

| CassieCard | 56 | 2 | 53 | |

| CreditAggie | 56 | 2 | 56 | |

| Flyingifr | 56 | 2 | 56 | |

| joeyv1985 | 56 | 2 | 56 | |

| kilroy8 | 56 | ? | 56 | |

| TMB_ | 56 | 2 | 56 | |

| mrsgrits | 57 | 2 | 57 | |

| mgood | 58 | 2 | 55 | |

| sarge12 | 59 | 2 | 59 | |

SENSITIVE [60-69] | ||||

| coreysw12 | 61 | 2 | 60 | |

| CreditObsessedinFL | 61 | 2 | 56 | |

| NRB525 | 63 | 2 | 63 | |

| Remedios | 63 | 2 | 63 | |

Dogbert* | 64 | 2 | 64 | |

| OmarGB9 | 64 | 2 | 64 | |

| Birdman7 | 65 | 2 | 60 | |

| Revelate | 65 | 2 | 63 | |

| RehabbingANDBlabbing | 66 | 2 | 66 | |

| thornback | 66 | 2 | 66 | |

| Dumbee | 68 | 2 | 56 | |

| jayk1 | 69 | ? | 69 | |

VERY SENSITIVE [70-99] | ||||

K-in-Boston* | 70 | 3 | 70 | |

CreditCuriosity* | 72 | 3 | 72 | |

Dmessina666* | 72 | 3 | 72 | |

GApeachy | 72 | 3 | 72 | |

jasonbourne84's DH | 72 | 3 | 72 | |

Kenro* | 72 | ? | 72 | |

Brian_Earl_Spilner* | 78 | 3 | 72 | |

GOLDEN CHALICE WINNER AND |

|

| ||

Adkins | 80 | 3 | 80 |

* FORMER AWARD WINNERS * |

MEMBER NAME | AWARD | TROPHY | FOR | DATE |

Brian_Earl_Spilner | GOLDEN CHALICE |

| Lowest rating: 76 | |

Brian_Earl_Spilner | GOLDEN SWORD |

| Record Low Rating: 76 | |

CreditCuriosity | GOLDEN CHALICE |

| Lowest rating: 75 | |

Dmessina666 | GOLDEN CHALICE |

| Lowest rating: 78 | |

Dmessina666 | GOLDEN SWORD |

| Record Low Rating: 78 | |

Dogbert | GOLDEN CHALICE |

| Lowest rating: 76 | |

Dogbert | GOLDEN SWORD |

| Record Low Rating: 76 | |

juggernaut9 | GOLD KEY |

| Highest Rating: 37 | |

JWD1980 | GOLD KEY |

| Highest Rating: 40 | |

K-in-Boston | GOLDEN CHALICE |

| Lowest rating: 73 | |

Kenro | GOLDEN CHALICE |

| Lowest rating: 72 | |

Kenro | GOLDEN SWORD |

| Record Low Rating: 72 | |

LaHossBoss | GOLD KEY |

| Highest rating: 41 | |

Lulah | GOLD KEY |

| Highest Rating: 37 | |

Throckmorton's Wife | GOLD KEY |

| Highest Rating: 40 |

All awards are from this game: Adventure (1980) (Atari 2600) Level 3 play through

The Bat is awarded for best EQ 8 score with lowest Resilience Index score. The bat can fly away with any award - even a dragon!

Meet the creator of the Resilience Index.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - Sunday, March 7, 2021

@Anonymous OK, finally have some new data with a 1 point change to the resilience index score.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - Sunday, March 7, 2021

@Anonymous I only pulled Ex, and EQ, this time. I had 36 bucks and some change in rewards on Amex Magnet card that has been dormant for 6 months. This will get rid of the rewards, show activity on that card, and let me see that I did become more resilient. The latest score for TU was the same on Feb.26.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EQ FICO Resilience Index Leaderboard - Sunday, March 7, 2021

@sarge12 wrote:@Anonymous OK, finally have some new data with a 1 point change to the resilience index score.

Welcome back, @sarge12 !

So you go from 59 to 58 and I don't even have to move the row in the table. That's ok...us Moderates aren't so bad, even if the Very Sensitive crowd has all the fun and fast cars.